Portfolio Management

portfolio:new_trade()

Creates a new empty trade in the portfolio.

Returns: Trade object

local trade = portfolio:new_trade()

portfolio:n_open_trades()

Gets the number of open trades in the portfolio.

Returns: number

local n_open_trades = portfolio.n_open_trades

portfolio:trades()

Returns all active trades in the portfolio.

Returns: table of Trade objects

for _, trade in ipairs(portfolio:trades()) do

print(trade.pnl)

end

portfolio:history()

Returns the PnL history of the portfolio.

Returns: table of numbers

local history = portfolio:history()

for i, pnl in ipairs(history) do print(i, pnl) end

portfolio:pnl()

Gets the current portfolio profit and loss.

Returns: number

local current_pnl = portfolio:pnl()

portfolio:value()

Gets the current portfolio value (PnL + starting cash).

Returns: number

local current_value = portfolio:value()

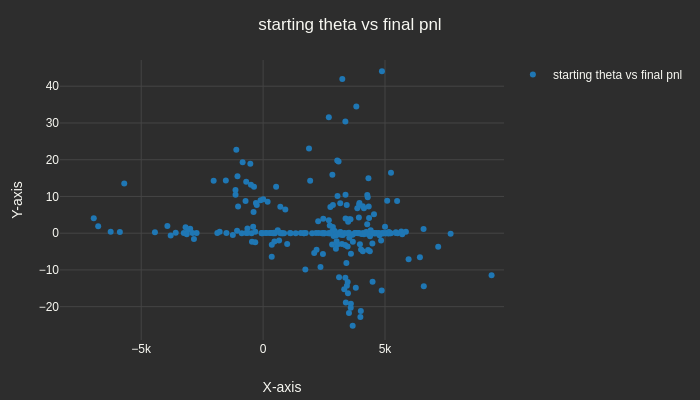

portfolio:delta() / portfolio:theta()

Gets the current portfolio delta or theta.

Returns: number

if portfolio:delta() > 10 then -- Adjust if delta too high

-- Hedging logic

end

portfolio:last_trade()

Gets the most recently opened trade.

Returns: Trade object

local latest = portfolio:last_trade()

portfolio:count(key: string, inc: option[number])

Count events in the portfolio. These are reported to the user in a final table.

Parameters: key (string) - key to count, inc (number) - amount to increment by

portfolio:count("ProfitTargetHit", 2) -- increment the count of "ProfitTargetHit" by 2

portfolio:count("ProfitTargetHit") -- increment the count of "ProfitTargetHit" by 1

portfolio:count("ProfitTargetHit", -1) -- decrement the count of "ProfitTargetHit" by 1

portfolio:trade(id)

Gets a trade by ID.

Parameters: id (number) - ID of the trade

Returns: Trade object

local specific_trade = portfolio:trade(3)

Trade Operations

trade.pnl

Gets the profit and loss of the trade.

Returns: number

if trade.pnl > 500 then trade:close() end

trade.cash

Gets the cash used or made from the trade.

Returns: number

trade:risk_graph()

Show the risk graph of the trade in the risk-graph tab. Up to 200 risk graphs are allowed per run.

Returns: table

if trade.pnl < - 5000 -- let's see what's happening

trade:risk_graph()

end

trade.dit

Gets the maximum days in trade.

Returns: number

if trade.dit > 30 then trade:close() end

trade.dte

Gets the minimum days to expiration of the trade.

Returns: number

if trade.dte < 7 then trade:close() end

trade.id

Gets the id of the trade.

Returns: number

trade.delta / trade.theta

Gets the delta or theta of the trade.

Returns: number

if math.abs(trade.delta) > 5 then

-- Adjust to neutral delta

end

trade:close(option[string])

Closes all legs in the trade.

Parameters: reason (string) - optional reason for closing the trade

if trade.pnl > 500 then trade:close("ProfitTargetHit") end

trade:erase()

Removes the trade from the portfolio and erases any commissions.

trade:add_leg(TradeLeg)

Adds a new leg to the trade.

Parameters: TradeLeg (created using Put() or Call())

trade:add_leg(Call("LC", Delta(30), 30, 1))

trade:add_leg(Put("SP", Delta(-30), 30, -1))

trade:has_leg(name)

Checks if the trade has a leg with the given name.

Parameters: name (string) - name of the leg

Returns: boolean

if trade:has_leg("LC") then print("Has long call") end

trade:close_leg(name: str, option[erase: bool])

Closes a specific leg in the trade.

name (string) - name of the leg to close

erase (boolean) - optional, default is false. if true, it's like the leg never existed

if trade:has_leg("LC") and trade:leg("LC").mid > 500 then

trade:close_leg("LC")

end

trade:adjust(selector, name)

Adjusts a leg of the trade using a selector.

Parameters:

- selector: Selector to use for adjustment

- name (string): Name of the leg to adjust

Returns: boolean (success)

-- Adjust leg "LP" to make trade delta -5. Accounts for quantity of named leg.

trade:adjust(TradeDelta(-5), "LP")

trade:leg(name)

Gets a specific leg by name.

Parameters: name (string) - name of the leg

Returns: Leg object

local my_leg = trade:leg("LC")

print(my_leg.strike, my_leg.delta)

Global Variables

underlying_price

Current price of the underlying asset (index/stock/ETF).

Type: number

if underlying_price < 20 then -- VIX is low

-- Enter positions

end

day_of_week

Current day of the week.

Type: string ("Mon", "Tue", "Wed", "Thu", "Fri", "Sat", "Sun")

if day_of_week == "Mon" then -- Entry on Monday

-- Enter positions

end

hour

Current hour of the day (0-23).

Type: number

if hour == 16 then -- Market close (4pm EST)

-- Manage positions

end

last_trade

Last trade opened. May be nil if no trades have been opened yet or if most recent trade has been closed.

Type: Trade

if last_trade != nil and last_trade.dit >= 3 then

-- open new trade ... not shown.

end

O

Global writable table that persists between ticks.

Useful for storing data between ticks. here's

-- ... note were only showing a subset of the code here. we'd also want to set O[trade.id] = 0 when we open the trade.

if trade.pnl > O[trade.id].pnl + 400 then -- if we made $400 in a single day (tick) then just close.

trade:close()

end

-- ... other operations.

-- store the pnl of the trade at end of tick code.

O[trade.id] = trade.pnl

Complete Examples

Put Credit Spread Strategy

-- Put Credit Spread Example

-- This is an example trade. It will look complex at first glance.

-- But, it contains most of the pieces to implement any strategy.

-- nearly all trades will want some sort of condition to open the trade.

-- this is often day of week and number of open trades.

if day_of_week == "Tue" and portfolio.n_open_trades < 5 and MA:EMA(10) > MA:EMA(20) then

trade = portfolio:new_trade()

dte = 45; qty = 2;

trade:add_leg(Put("SP", Delta(-10), dte, -qty))

-- use the strike of the short put to determine placement of the LP.

local sp = trade:leg("SP")

trade:add_leg(Put("LP", Strike(sp.strike - 50), dte, qty))

-- the 1st 200 print statements will go to your javascript console (ctrl+shift+j)

-- this is a nice way to debug your code

print(trade)

-- sometimes the strikes are not availabe so we end up with a trade

-- that is not 50-wide

local dist = sp.strike - trade:leg("LP").strike

-- make it like the trade never existed.

if dist > 75 or dist < 25 then trade:erase() end

end

-- nearly all strategies will want to check the trades each day for StopLoss or ProfitTarget

-- or adjustments.

for _, trade in ipairs(portfolio:trades()) do

if math.abs(trade.pnl) > 10000 then

trade:erase() -- can get rid of trades with bad data (but be careful!!).

elseif trade.pnl > 300 or trade.pnl < -2000 then

trade:close(trade.pnl > 0 and "PT" or "SL") -- PT or SL

elseif trade.dte < 2 then

trade:close("Days in Trade") -- the message to close gets logged to "User Counts tab"

end

end

VIX Trading Strategy

-- VIX trading strategy example

local dte = 41

-- Open new trades on Mon/Wed/Fri when VIX is below 20

if (day_of_week == "Mon" or day_of_week == "Wed" or day_of_week == "Fri")

and underlying_price < 20 then

local trade = portfolio:new_trade()

-- Short call 2 points below current price

trade:add_leg(Call("Call", Strike(underlying_price - 2.0), dte, -1))

-- Long call at strike 32 for protection

trade:add_leg(Call("LC", Strike(32), dte, 2))

end

-- Manage existing trades

for _, trade in ipairs(portfolio:trades()) do

-- Close long call if mid price > 500

if trade:has_leg("LC") and trade:leg("LC").mid > 500 then

trade:close_leg("LC")

print("LC closed", date)

-- Close entire trade if less than 7 days to expiration

elseif trade.dte < 7 then

trade:close()

elseif trade.pnl > 600 or trade.pnl < -500 then

trade:close() -- PT or SL

end

end

Iron Condor Strategy

-- IRON Condor Ex

function create_iron_condor(dte, short_delta, qty)

local trade = portfolio:new_trade()

local width = 25 -- points wide IC

-- Short call

trade:add_leg(Call("SC", Delta(short_delta), dte, -qty))

local sc_strike = trade:leg("SC").strike

-- Long call

trade:add_leg(Call("LC", Strike(sc_strike + width), dte, qty))

-- Check if the short call and long call have the same strike

if trade:leg("SC").strike == trade:leg("LC").strike then

portfolio:count("same-strike")

trade:close_leg("LC", true)

trade:add_leg(Call("LC", Strike(sc_strike + 2 * width), dte, qty)) -- could also close leg and re-open

-- now check again and erase trade if still same:

if trade:leg("SC").strike == trade:leg("LC").strike then

trade:erase()

return nil

end

print(trade)

end

-- log the width we ended up getting in user-counts

portfolio:count("width:" .. tostring(trade:leg("LC").strike - trade:leg("SC").strike))

-- Short put

trade:add_leg(Put("SP", Delta(-short_delta), dte, -qty))

local sp_strike = trade:leg("SP").strike

trade:add_leg(Put("LP", Strike(sp_strike - width), dte, qty))

return trade

end

-- Open new iron condor on Mondays

if day_of_week == "Mon" then

local qty = 1

local dte = 45

local short_delta = 20

local ic = create_iron_condor(dte, short_delta, qty)

end

Dynamic Delta Adjustment

-- Strategy that dynamically adjusts delta based on day of week

local trade = portfolio:new_trade()

-- Initial neutral position

local dte = 30

local qty = 1

trade:add_leg(Put("ShortPut", Delta(-30), dte, -qty))

trade:add_leg(Put("LongPut", Delta(-50), dte, qty))

-- Check and adjust every day

if day_of_week == "Mon" then

-- Monday: bearish bias

trade:adjust(TradeDelta(-3), "ShortPut")

elseif day_of_week == "Fri" then

-- Friday: bullish bias

trade:adjust(TradeDelta(2), "ShortPut")

else

-- Other days: neutral

trade:adjust(TradeDelta(0), "ShortPut")

end

for _, trade in ipairs(portfolio:trades()) do

if trade.pnl > 1000 then

trade:close("Profit Target")

elseif trade.pnl < -1000 then

trade:close("Stop Loss")

elseif math.abs(trade.delta) > 4 then

trade:adjust(TradeDelta(0), "ShortPut")

end

end

Put Back Ratio

-- Put Back Ratio

short_qty = 2

long_qty = 3

if day_of_week == "Tue" then

trade = portfolio:new_trade()

dte = 45;

trade:add_leg(Put("SP", Delta(-2), dte, -short_qty))

sp_mid = trade:leg("SP").mid

print("sp_mid:", sp_mid)

-- use the mid of the short put to determine placement of the LP.

trade:add_leg(Put("LP", Mid(sp_mid / long_qty - 1.0), dte, long_qty))

-- the 1st 50 print statements will go to your javascript console (ctrl+shift+j)

-- this is a nice way to debug your code

print(trade)

end

-- nearly all strategies will want to check the trades each day for StopLoss or ProfitTarget

-- or adjustments.

for _, trade in ipairs(portfolio:trades()) do

if math.abs(trade.pnl) > 10000 then

-- trade:erase() -- can get rid of trades with bad data (but be careful!!).

elseif trade.pnl > 1000 or trade.pnl < -2000 then

trade:close(trade.pnl > 0 and "PT" or "SL") -- PT or SL

end

end